A Thorough Analysis of the Development Path of Clean Energy

The issue of climate change is becoming an important lever to drive the global energy transition and even the adjustment of the international order. The trend towards green and low-carbon development is an irreversible trend of the times. China is actively and steadily advancing the "dual carbon" work, and the economy has entered a stage of accelerating green and low-carbon high-quality development. In recent years, the transformation and construction of fossil energy infrastructure and the research and application of renewable energy technologies have accumulated energy for a more in-depth, more orderly, more efficient and more secure energy transition in the next stage.

The China Petroleum & Chemical Corporation Economic and Technological Research Institute recently released the "China Energy Outlook 2060 (2024 Edition)" report, which predicts that coal consumption will increase slightly in the short term and accelerate its decline in the medium and long term; oil demand will enter the final stage of growth, with the peak expected to be reached in the mid-term of the "14th Five-Year Plan", and then accelerate its decline after the peak. The total energy consumption in China will peak between 2030 and 2035, with the peak exceeding 6.2 billion tons of standard coal. At that time, the proportion of non-fossil energy consumption will be around 30%. During the peak energy consumption stage (2023-2035), clean energy sources such as photovoltaic, wind energy, and natural gas will become the energy types contributing the most to growth. In the next 12 years, the consumption of photovoltaic and wind energy will increase by as much as 240% and 40% respectively, and the proportion of non-fossil energy will rise from 18% to 34%; the consumption of natural gas will reach 575.5 billion cubic meters, and its proportion will increase from 9% to 12%; the combined contribution rate of these three to the growth of total energy consumption will exceed 150%.

This edition selects relevant content from "China Energy Outlook 2060 (2024 Edition)", analyzing the development prospects of clean energy such as natural gas, non-fossil energy, and hydrogen under the background of accelerating the construction of a new energy system in our country. Please stay tuned.

The text and images in this edition are provided by the China Petrochemical Economic and Technical Research Institute.

Natural Gas: Fulfilling the Role of "Bridge Energy"

The development prospects depend on the overall energy security and the transformation process.

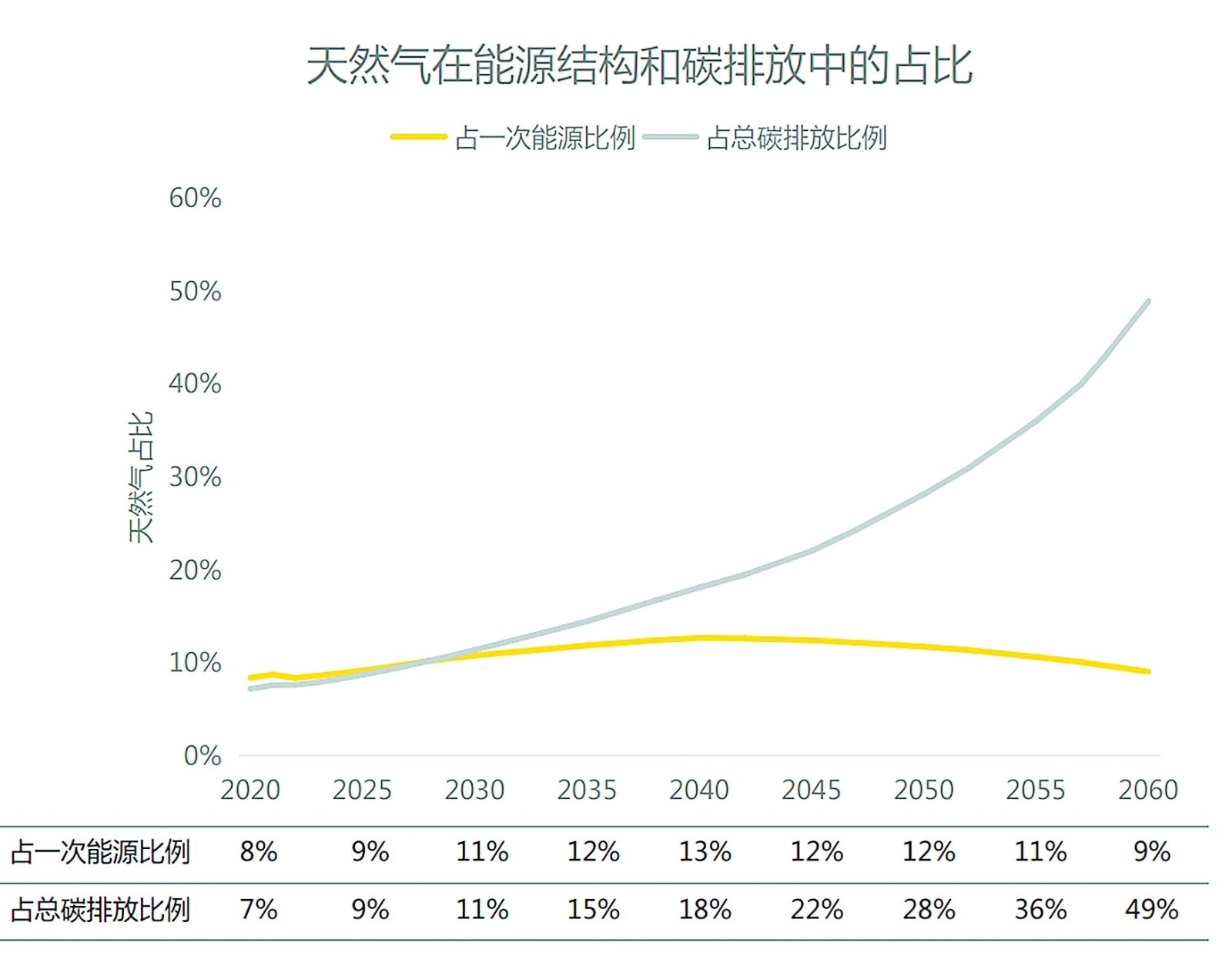

Although the European gas crisis has a short-term impact on the global energy market, it is difficult to overturn the positioning of natural gas as a "bridge energy source". It is expected that China's natural gas demand will peak around 2040, with a peak of approximately 610 billion cubic meters, accounting for nearly 13% of primary energy consumption; by 2060, it will be approximately 400 billion cubic meters, accounting for about 9% of primary energy consumption.

In the near and medium term, the substitution of natural gas for coal has weakened, and the growth momentum of consumption has slowed down. Particularly in the power generation sector, the growth momentum of natural gas consumption, as a "bridge energy", has weakened. It is expected that by 2025, the proportion of natural gas in primary energy consumption will be approximately 9%. In the later period, with the accelerated development of renewable energy, the pressure of "carbon peak", as well as the gradual improvement of the economy and the reduction in the cost of natural gas imports, the growth of natural gas consumption will accelerate. It is expected that by 2030, the proportion of natural gas in primary energy consumption will be approximately 11%.

In the medium and long term, the substitution space for natural gas will be taken over by electricity and hydrogen, and the growth momentum of consumption will weaken. In the fields where the substitution of natural gas is relatively easy, such as building materials and light industry, the substitution has already been completed, and the remaining space is limited. At the same time, some industries are gradually entering the stage of power substitution, and hydrogen technology has achieved breakthrough progress. The advantages of natural gas in replacing high-carbon energy and serving as a flexible power source have encountered challenges, and consumption growth will slow down until it reaches a plateau. It is expected that around 2040, natural gas consumption will peak, reaching 610 billion cubic meters, accounting for nearly 13% of primary energy consumption.

In the long term, natural gas will gradually be replaced by electricity and hydrogen, and consumption will enter a downward phase. With the development of electrification and the decline in hydrogen costs, the consumption area of natural gas is gradually being squeezed, and the demand has passed the plateau and begun to decline. It is expected that by 2060, natural gas consumption will be approximately 400 billion cubic meters, accounting for about 9% of primary energy consumption.

As the green and low-carbon transformation of the energy system progresses in depth, the carbon emissions from the use of natural gas have been continuously increasing in the total carbon emissions. The proportion of natural gas consumption in primary energy has "first risen and then declined", but its carbon emission proportion in the total carbon emissions will continue to rise. It is expected that by 2060, nearly half of the total national carbon emissions will be contributed by clean and efficient natural gas, and the energy system will be fundamentally optimized.

Industry and power generation have a significant impact on natural gas consumption.

The two gas-consuming sectors with the greatest potential for development and influence in the future are industry and power generation. The combined contribution of these two sectors to the changes in gas consumption will exceed 80%.

Before the "carbon peak" target is achieved, natural gas is striving to facilitate the transformation of the end energy system from high-carbon emissions to low-carbon emissions. During this period, to achieve the "carbon peak" target in a stable manner and prevent air pollution, promoting the clean and low-carbon adjustment of fuels is the preferred approach. The industrial sector is the main driver of consumption growth.

From the point when "carbon peak" is reached to when the demand for natural gas reaches its peak, the role of natural gas in improving the terminal energy structure weakens, while its role in optimizing the power system strengthens. During this period, as domestic industries undergo transformation and upgrading and technological improvements, the demand for electricity is more vigorous than that for fossil fuels. The decline in the increase in natural gas consumption in the industrial sector leads to a reduction in the overall consumption increase. At the same time, the requirements for the cleanliness and stability of the power system are also increasing. The demand for natural gas in the power generation sector first accelerated its growth and then gradually stabilized. In the transportation sector, in addition to facing the challenge of electrification, the competition with hydrogen vehicles in long-distance transportation where natural gas can play a role is becoming increasingly fierce.

Before the realization of the "carbon neutrality" goal, electricity and hydrogen have accelerated their penetration in the end-use energy sector, while natural gas has focused on ensuring the safety and stability of the power system and meeting the fuel demands in non-electrified areas. As the electrification progresses and the cost of hydrogen decreases, the space for natural gas is gradually being squeezed, and its demand has begun to decline after reaching a plateau. The portion used as a general industrial fuel is gradually being replaced by electricity, and some parts of high-temperature heating and reducing agents are being replaced by hydrogen. The decline in population has led to a decrease in building energy consumption, and natural gas used for cooking, heating water or heating will also be replaced by electricity or blended hydrogen to some extent. The growth in the scale of renewable energy power generation has driven an increase in peak load capacity demand, but the installed capacity utilization rate has been continuously declining, and the consumption of gas for power generation has steadily decreased.

The demand for LNG and the cost of supply are both expected to rise in the long term.

The import volume of LNG (liquefied natural gas) has been steadily increasing in the near to medium term, but the uncertainty increases after 2028.

Domestic natural gas serves as a stable foundation for the growth of natural gas demand. The domestic self-sufficiency rate of natural gas has remained above 50% for a long time. It is expected that domestic natural gas production will reach its peak around 2040, which is close to the peak period of natural gas demand. The peak volume will be approximately 310 billion cubic meters, and it is still likely to be around 250 billion cubic meters by 2060. Based on this, the peak of total natural gas imports is likely to be within 300 billion cubic meters.

After 2028, there may be new imported pipeline gas projects entering the market. Russia is actively promoting the construction of the China-Russia-China Pipeline. The Xi'an Declaration of the China-Central Asia Summit clearly states that it supports accelerating the construction of the China-Central Asia Gas Pipeline D line.

The demand for LNG imports is highly uncertain, but the rising cost of future supply may drive the implementation of new import pipeline gas. According to estimates, the peak import volume of LNG will reach 233 billion cubic meters in 2045, with an average annual growth rate of 4.3%; if the Central Asia D line is completed and put into operation after 2028, the peak import volume will drop to 203 billion cubic meters, with an average annual growth rate of 3.7%; if the China-Russia Central Line is completed and put into operation after 2030, the peak import volume will fall to 183 billion cubic meters, with an average annual growth rate of 3.3%; if both pipelines are completed and put into operation, the peak import volume will drop to 153 billion cubic meters, with an average annual growth rate of 2.5%. In any case, there is long-term growth potential for LNG import demand.

The cost level of the future LNG supply is generally higher than that of the already operational projects. The long-term cost of LNG supply is expected to rise, and this consideration of price may promote the implementation of new import pipeline gas projects. At the same time, the majority of the future global LNG supply will come from the United States. The consideration of diversifying import sources to reduce risks also has an impact on the allocation of imported LNG and imported pipeline gas.

Non-fossil energy: Has become the main component of the energy system's growth.

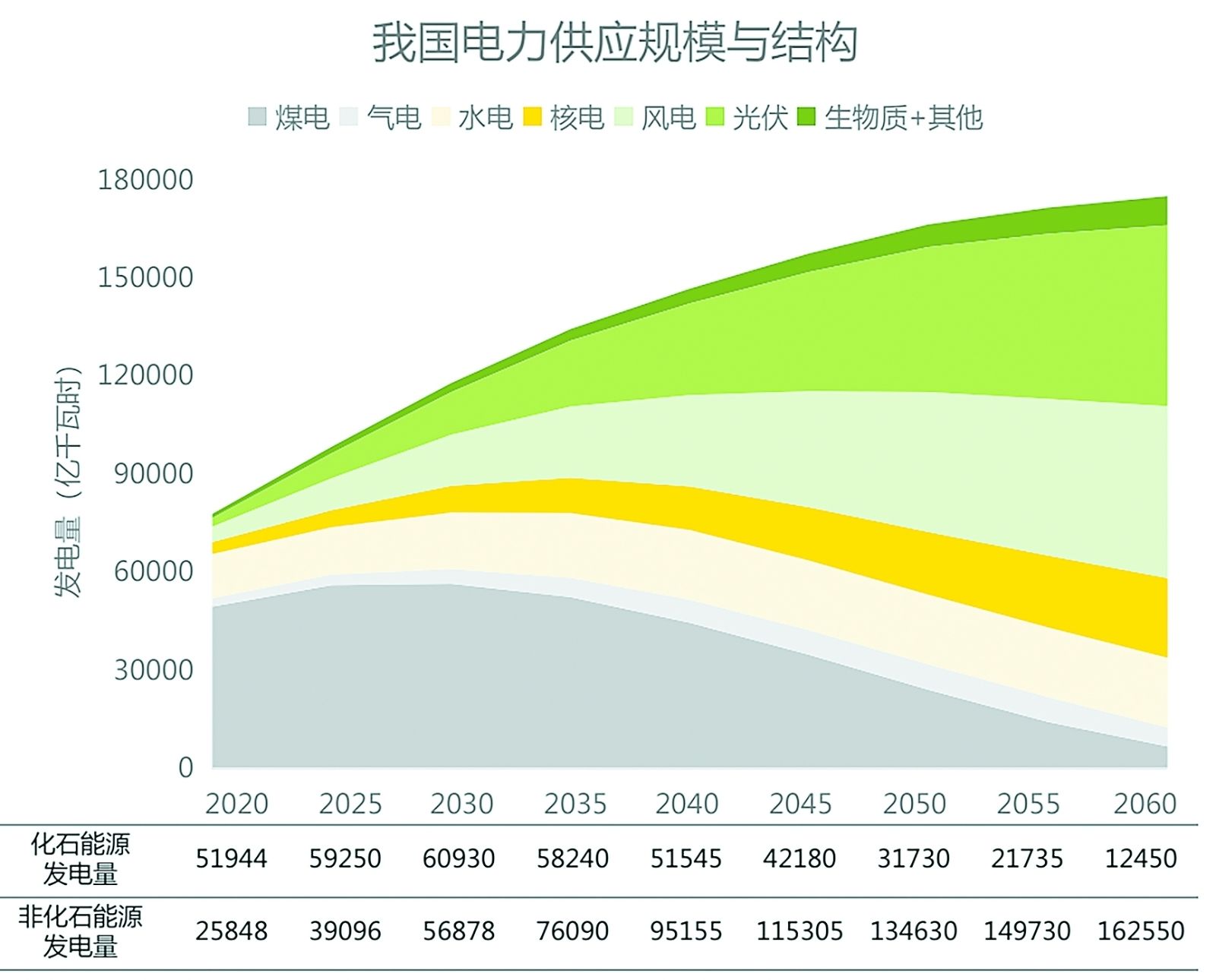

(Units: billion kilowatt-hours)

It will become the main source of energy supply for our country around 2045.

In 2023, the supply of non-fossil energy in China's energy consumption system increased to 994 million tons of standard coal, accounting for 17.8% of the total primary energy consumption. Among them, the installed capacities of hydropower, wind power and photovoltaic power have consistently ranked first globally for many consecutive years.

Overall, non-fossil energy has become the main source of energy growth in China's energy system, and it will become the main source of energy supply in China by around 2045. Recently, China's photovoltaic and wind power and other renewable energy sources have been accelerating their expansion in scale. The new power system of "new energy + energy storage" is gradually being constructed. It is expected that by 2030, China's non-fossil energy power generation will increase to 5.7 trillion kilowatt-hours, accounting for nearly half of the total power generation. The non-fossil energy power generation capacity will increase to over 2.6 billion kilowatts, exceeding 60% of China's total power generation capacity. In the medium term, non-fossil energy will become the main source of energy supply in China. As the new energy system is further improved, the power generation volume and capacity of non-fossil energy will both surpass those of fossil energy. Due to the reduction in the space for substitution, the growth rate of non-fossil energy power generation capacity will slow down. In the long term, non-fossil energy will become the dominant energy source in China. It is expected that by 2060, China's non-fossil energy power generation will exceed 16 trillion kilowatt-hours, accounting for 93% of the total power generation.

Photovoltaic and wind power have made the greatest contribution to the growth of non-fossil energy. The steady development of coastal nuclear power has significantly enhanced the contribution to the growth of non-fossil energy. Thanks to advantages in resources, costs and scale, wind power and photovoltaic energy are the main components of the increase in non-fossil energy power generation in China, accounting for more than 70% of the increase in non-fossil energy installed capacity over the long term. The steady development of coastal nuclear power supports the stable growth of nuclear power, and its contribution to the increase in non-fossil energy power generation has increased from about 10% recently to about 20% in the long term. Hydropower still has some growth in the near future, but after 2040, due to the limited availability of new exploitable hydropower resources and the basic saturation of installed capacity, the power generation will remain basically stable. With technological breakthroughs, the application of biomass in electricity is constantly increasing, and its proportion in the increase of non-fossil energy power generation will increase from about 5% recently to about 10% in the long term. Other non-fossil energy sources such as biomass energy, geothermal energy and ocean energy are not only beneficial supplements for achieving the "dual carbon" goal, but also effective means for air pollution control and solid waste treatment.

Strengthen the collaboration among the three parties to ensure the stable supply of non-fossil energy-based electricity

The rapid development of wind power and photovoltaic energy has placed greater demands on the flexibility of the power system. The collaboration among the power grid, supply and demand sides has been continuously strengthened.

On the supply side, coal-fired and gas-fired power plants play a crucial role in peak load regulation as reliable thermal power capacity. Pumped storage and battery energy storage will see significant growth in the coming years. As the proportion of non-fossil energy power generation increases, the peak load regulation role of coal-fired and gas-fired power plants as reliable power sources becomes more prominent. The hours of coal power generation have been continuously decreasing, with a drop of over 60%. The hours of natural gas power generation have risen initially and then declined, with a drop of nearly 50% by 2060. In terms of energy storage, after the operation of 300 million kilowatts of projects in 2025, the scale of energy storage has expanded rapidly, and by 2050, it will provide more than 400 million kilowatt-hours of electricity.

In terms of the power grid, the "West-to-East Power Transmission" and "North-to-South Power Supply" patterns remain unchanged. Large-scale cross-regional industrial transfer and power transmission coexist. In the future, major large-scale clean energy bases will mainly be located in the west and north, while the power demand centers will still be in the east and central regions. The scale of cross-regional power flow will continue to expand. It is expected that by 2050 and 2060, the cross-regional and cross-provincial power flow will reach 810 million and 830 million kilowatts respectively. Accelerating the development of ultra-high voltage power grids is crucial. In the near and medium term, two synchronous power grids in the east and west will be initially formed, and the western power grids will be interconnected through multiple DC asynchronous lines. In the long term, a strong and reliable synchronous power grid between the east and west will be fully established. It is expected that by 2050 and 2060, the transmission capacity of China's ultra-high voltage DC projects will reach 4.9 billion and 5.1 billion kilowatts respectively.

On the demand side, demand-side management will play a crucial role in maintaining the balance of supply and demand in the power system and will become an economic option for ensuring power security. Adjustable loads, as an efficient flexible resource, have huge potential for development as the market mechanism becomes more established. It is expected that by 2025, 2030, and 2060, the capacity of adjustable loads in China will respectively reach 800 million, 1.2 billion, and 3.5 billion kilowatts, accounting for approximately 5%, 7%, and 15% of the maximum load. In the near term, adjustable loads will mainly aim to alleviate the tension in power supply and demand, while in the medium and long term, they will aim to both alleviate the tension in supply and demand and support the consumption of new energy.

Hydrogen Energy: Actively and Deeply Participating in the Carbon Neutrality Process

Green hydrogen is expected to cross the economic "inflection point" between 2030 and 2035.

In 2023, the hydrogen supply in China was 354.1 million tons. Among them, coal-based hydrogen production accounted for 64.6% and electrolysis of water for hydrogen production accounted for less than 0.5%. With the strengthening of carbon emission constraints and the improvement in the economic efficiency of electrolysis of water for hydrogen production, the fossil energy-based hydrogen production in China will peak and decline during the "14th Five-Year Plan" period, and electrolysis of water for hydrogen production will enter a large-scale development stage around 2030. It is expected that by 2060, China's hydrogen supply will increase to 858 million tons, with coal-based blue hydrogen and natural gas-based blue hydrogen accounting for 7% and electrolysis of water for hydrogen production accounting for 89.5%, and the energy consumption for hydrogen production will account for 18% of China's primary energy consumption.

In the near and medium term, gray hydrogen will be the dominant hydrogen source in China. It has mature technology and low prices, but the direct carbon emissions from hydrogen production account for approximately 4% of the total carbon emissions from China's energy activities. Currently, the scale of coal-based gray hydrogen and natural gas-based gray hydrogen in China is about 28 million tons, which is in a peak plateau period, accounting for about 78% of the total hydrogen supply. It is expected that after 2030, under the constraints of carbon emission policies, the increase in carbon emission costs will drive the cost of gray hydrogen to rise rapidly, resulting in weakened market competitiveness and a gradual reduction in supply, and it will basically exit the market by 2060.

Looking ahead, green hydrogen will become the dominant hydrogen source in China and play a key role in the process of making hydrogen supply and energy consumption more carbon-lean. With the upgrading of electrolysis water hydrogen production technology, intelligent manufacturing, and the cost reduction of renewable energy power generation working together, China's green hydrogen is expected to cross the economic "inflection point" between 2030 and 2035 and enter a stage of large-scale development. It is estimated that China's green hydrogen supply will increase to 3 million tons in 2030, reach 11.88 million tons in 2035, exceed 30 million tons between 2040 and 2045, and officially become the dominant hydrogen source in China (accounting for more than 50% of specialized hydrogen production), reaching 76.8 million tons by 2060.

Blue hydrogen is an important supplement to the low-carbonization of hydrogen sources in China and will accelerate its development after 2030. Although the development of blue hydrogen has its specific applicable scenarios, in general, the economic efficiency of blue hydrogen is inferior to that of gray hydrogen in the near and medium term, and inferior to that of green hydrogen in the long term, which limits the expansion of the blue hydrogen industry scale.

Hydrogen is a secondary and even tertiary energy source. The penetration and promotion of hydrogen energy and renewable energy will deeply reshape the energy supply and utilization model of our country.

The application scenarios have become increasingly diverse, and the total consumption volume will increase to 858 million tons by 2060.

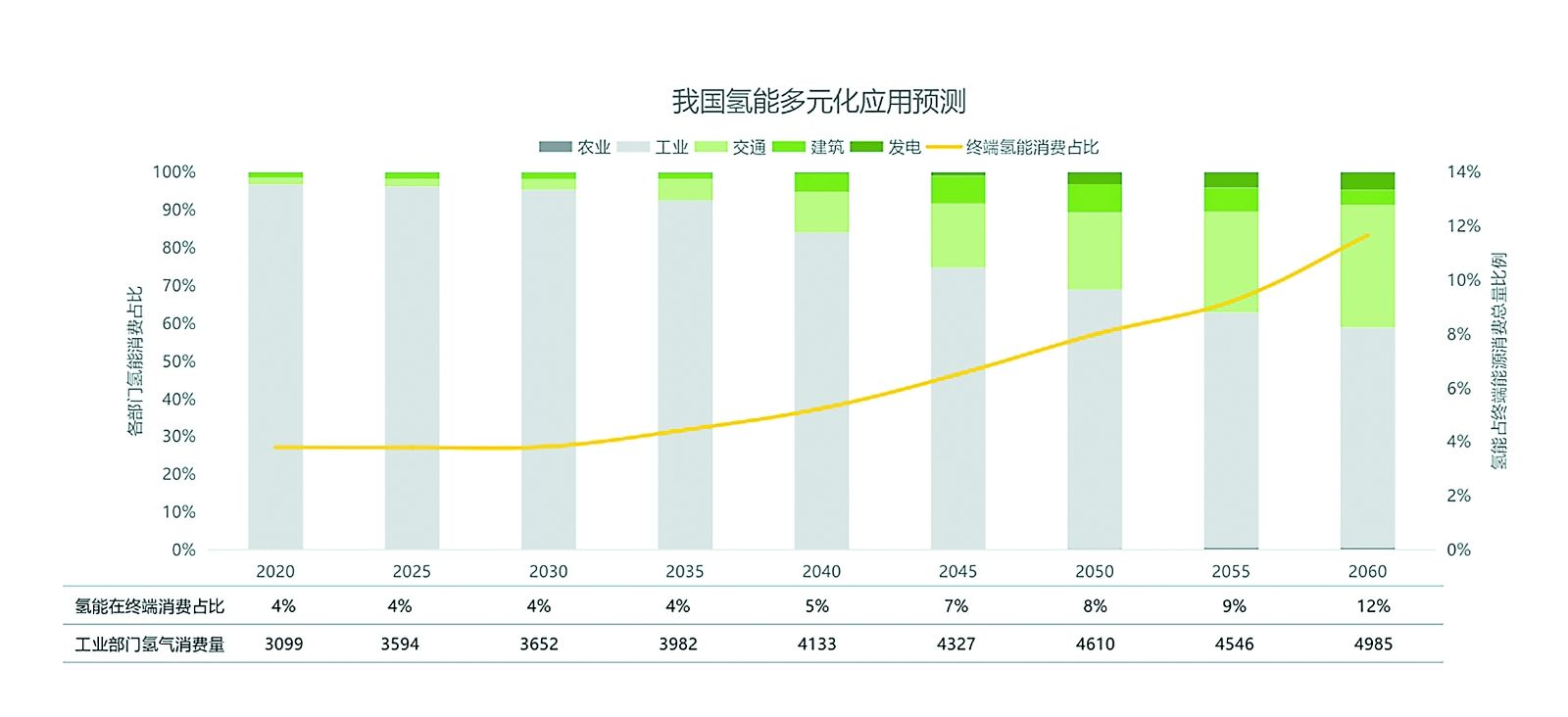

Looking forward to the future hydrogen energy society, hydrogen will play multiple roles such as fuel, raw material, and energy storage medium, and will deeply and extensively participate in the carbon neutrality processes of industries, transportation, construction, and power generation. It is expected that by 2060, China's hydrogen consumption will reach 85.8 million tons, accounting for nearly 12% of the country's total terminal energy consumption.

The growth process of hydrogen energy consumption in our country can be divided into three major stages:

Demonstration Development Stage (from now until 2035). During this period, applications such as hydrogen transportation, green hydrogen refining, and hydrogen metallurgy do not yet have an economic scale. Over 95% of hydrogen is still used in the industrial sector. It is expected that during this stage, the growth rate of China's hydrogen consumption will be slow, with an average annual growth rate of around 1.5%; the increase in hydrogen consumption will be limited, reaching 42.64 million tons, an increase of about 23% compared to the current level.

Rapid expansion phase (2036 - 2050). During this period, it is estimated that China's hydrogen consumption will be approximately 679 million tons. Although the industrial sector will still account for about two-thirds of hydrogen consumption, the application scenarios of hydrogen will shift from mainly focusing on petrochemicals and chemical industries to metallurgy, cement, glass, ceramics, etc., and will be applied on a large scale in transportation and construction fields. It is expected that the proportion of hydrogen in China's total terminal energy consumption will increase from 4.5% to 8%.

The multi-application stage (2051 - 2060). China's energy transition has entered the final stage of carbon peak, and "fuel" will be on par with "raw material" as the main application of hydrogen energy. It is expected that the consumption scale of hydrogen energy in China will expand by about 26%. The diversified application of hydrogen energy mainly manifests in three aspects: First, as a cost-effective zero-carbon fuel, it is widely used in the industrial sector to provide high-grade heat. Second, hydrogen in the form of hydrogen-based fuels such as methanol and ammonia helps industries such as aviation and water transportation to deeply decarbonize. Third, hydrogen storage and hydrogen power generation will become an important part to ensure the safety and stability of China's power system.